The Innovation Spectrum TM

Innovation today is like the Wild West. There’s a lot of soapbox rhetoric being bandied about as the concept of innovation is heralded as the cure-all for all that ails, while the effects of many implementations are probably closer to snake oil than anything else. The vast majority of those wielding the term “innovation” have an ankle-deep understanding of its meaning—at best—and I would argue that they know even less about how it’s done.

This article is the result of my interest in the most recent innovation initiatives that I’m seeing both in Australia and globally. Within Australia specifically, the government is charging headlong into an initiative-driven innovation boom. Launched in mid-2016, they’ve erected a four-pillar framework to bridge a chasm with top innovative nations around the globe. It aims to tackle obstacles such as tax breaks, research funding, access to data, and even shoring up a steady decline in top talent that’s often enticed overseas by U.S. firms.

This article, however, is not directed at the initiatives of the Australian government or a particular firm for that matter; it is more broadly focused on the labelling and the valuation of the outcomes that innovation initiatives produce. The term innovation, as it is often used today, provides us with a vibrantly coloured picture of ambiguity at full gallop. The word so widely attributes novelty to the most basic of implementations in technology or changes in processes, products, and services that it nearly renders it nothing more than pure management speak. Of course, I can appreciate that there’s good reason for the ambiguity: much of it comes down to complexity.

Let me run through a few questions just to illustrate how quickly the waters can begin to muddy when one gets on the topic of innovation. And how a simple consideration for novelty has evolved into a label of innovation (INSEAD, 2011). To make this point, simply think of any product or service at random, maybe something within your field of view. Now, does this product or service involve something new, a new feature perhaps? Is it entirely new or are parts of it new? Is it new to the entire world, an industry, or just a company? Does the example solve a problem? How well does it solve the problem? Is it the whole problem or just part of it? Do you think it has a positive ROI for the provider? Does it involve technology? Do you think it might be patented or protected in some way? Do the consumers benefit, the shareholders, or both? Is it available in a mainstream market or only in an emerging market?

I think you see where I’m going with this. There are several things going on here, so yes, it’s complicated. But these questions and many others really need to be considered before randomly slapping the innovation label onto a simple product iteration. If you’re an individual whose stock-in-trade depends on innovation, then having a consistent, robust, localized definition is absolutely paramount to your success. And frankly speaking, the ability to reliably weigh and measure an outcome in a business context isn’t a “nice to have,” it’s a “must have.” This is especially true for leaders where the health—and quite literally, the future—of an organisation can depend on its ability to satisfy existing, but most importantly, future market demands.

With that said, below is the definition for innovation that I use. It cuts through the management speak during conversations and meetings and provides a context for action and predictable, measurable, results. And importantly, it’s one that can easily be explained over a cup of coffee.

Definition of Innovation

An innovation is a change to or an introduction of a technology, process, product, or service diffused at the global or industry level. Its degree of novelty is characterised by an increase in its solution above and beyond quantitative and qualitative improvements, and it demonstrates a measure of evolution with either a substantial impact or disruption to mainstream markets, or it leads to the creation of new markets.

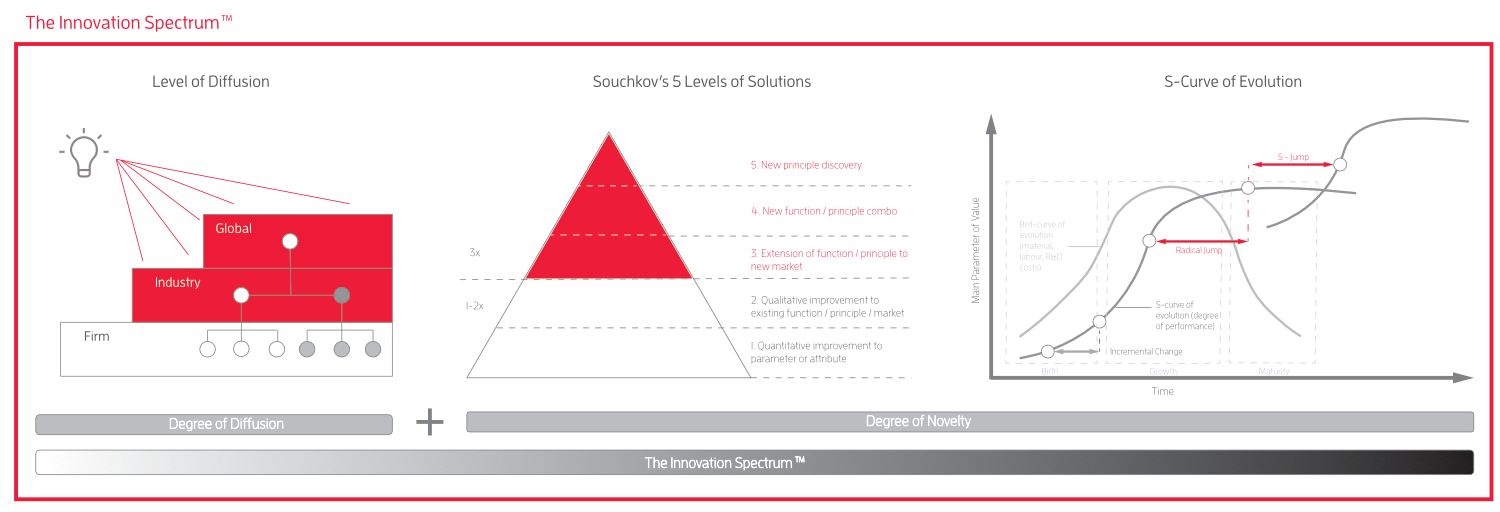

In short, this means that there are effectively three things you should be concerned with when trying to define an innovation: diffusion, where is it being introduced; solution, how well it solves a problem; and evolution, to what extent it impacts markets. Now let me unpack the moving parts.

Using Diffusion as a Filter

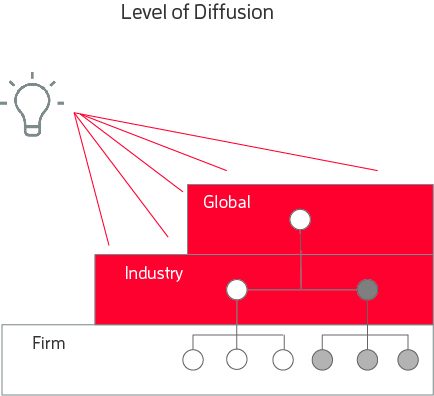

I’ll start with diffusion. The way in which many people—consultants especially—use the term innovation is quite problematic, especially with respect to how it relates to diffusion. It’s often used in a way that perpetuates a notion that you can plug-and-play competitor improvements in an organisation and still call it innovation. Unfortunately, this is simply not the case. But the beautiful thing about diffusion is that by using this lens, you can very easily and very quickly reveal whether a product or service is an innovation. And it’s for this reason that I use diffusion as the first filter in the Innovation Spectrum TM.

The approach is fairly straightforward; here’s how it works: diffusion represents the level of adoption of a product or service. We use three levels to categorise diffusion: global, industry, and firm (Eurostat and OECD, 2005). When asking the diffusion question, you are effectively asking whether a given product or service is new to the world, new to an industry, or new to a firm. Simply assign the product or service to its respective level; as long as it’s either new to the world or new to an industry, it qualifies for the Innovation Spectrum TM. Now let’s have a look at each individual level.

- Global diffusion is the introduction of an innovation to the world. It is the highest and most challenging level to attain. Some examples include:

- The discovery and first use of x-ray technology in 1895 by W.C. Roentgen.

- Siebel’s introduction of the first digital CRM tool with sales force automation and contact management.

- Industry-level diffusion is the next level down. It’s an excellent place to be. Diffusion at this level means that the product or service already exists within the world, but this is the first time we are seeing its application in a given industry.

- The first use of x-ray technology in aviation security in the early 70s in the United States.

- The first use of a Siebel CRM in the Telco industry.

- Firm-level diffusion is the final level and lowest type of diffusion. It represents the adoption of a pre-existing industry innovation into a competitor firm. It’s not wrong; it’s just not innovation. You can think of this as being more along the lines of continuous improvement or the implementation of best practice.

- European adoption of x-ray technology in aviation security in the 80s.

- A second Telco company implementing CRM technology.

I’ll mention this point again just to allow the idea to detonate in your mind for a second: firm-level diffusion is not innovation. There is a trend across some organisations whereby an industry competitor’s technology or process is used for the first time and it’s labelled innovation. Again, this type of change is not necessarily wrong; it’s more in line with continuous improvement, but it is not innovation. Please don’t take this to mean that I am against continuous improvement or best practice implementation, that’s not the case—quite the opposite, in fact. Implementing industry best practice can be critically important to an organisation’s success; however, things like continuous improvement and best practice should not be conflated with innovation, as they are distinctly different.

I’ll use one final example about firm-level diffusion, because this wrongheaded line of thinking seems to be the most prolific of all. If, for instance, there was a woman—let’s call her Jane—who had no knowledge of the existence of a bicycle and its design and function was completely foreign to her. Then, if we presented Jane with a bicycle, and she went through the unboxing ceremony and had a good long ride around the block—only to walk in and declare how incredibly innovative the bicycle is as a mode of transportation, all because she had just ridden one for the first time, she would never be taken seriously. The same is true when an executive or consultant moves from one organisation to the next, within the same industry, and brings with her all the knowledge of competitor technologies and processes. The implementation of these types of industry competitor adoptions, although well-intentioned and completely new to the organisation, should hardly be considered innovation.

While there are three parts to the Innovation Spectrum TM, for many people, using diffusion as a filter may provide all the information they need to qualify their next innovation. And I’m confident that using global- or industry-level diffusion as a qualifier will substantially increase the outcome of your innovation efforts. Just assume you have a balanced scorecard in place and consider running a project. You’re presented with five solution options to choose from, all of equal impact and cost, but four of the five are diffused at the firm level. All else aside, you can choose the fifth option, knowing that it will directly impact your innovation index score and act as a lead indicator to some of your other metrics.

Let’s assume that a product was diffused at either the industry or global level. This means that we’ve landed on the spectrum and our product can be considered innovative. But that brings us to another question: how innovative is it? The next step then is to determine the level of novelty. I use two criteria for novelty: solution, the extent to which a system is able to deliver its function along a five-point hierarchy; and evolution, the level of advancement of the product or service along an S-curve of technology evolution.

Assessing for Novelty: The Solution Hierarchy

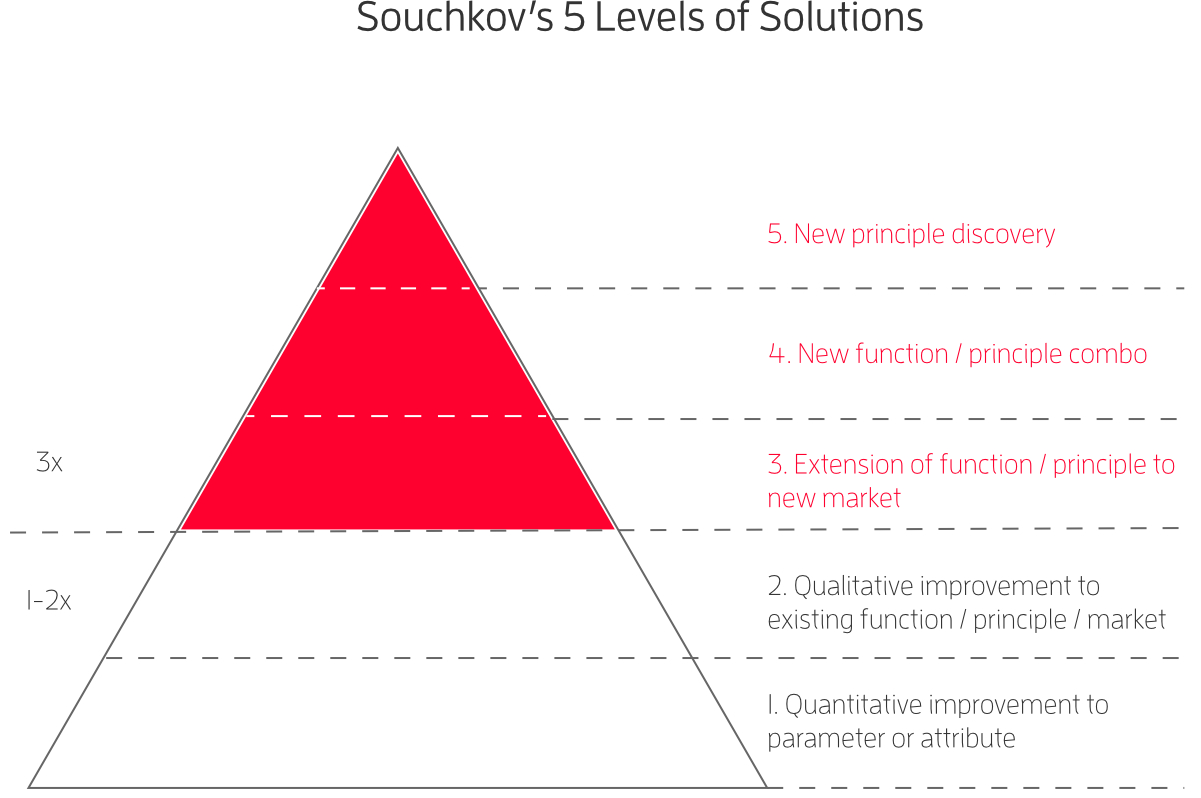

Before I dive into the explanation of the solution hierarchy, I’ll share some history about how it has evolved and where it takes its roots. The solution hierarchy that I use in the spectrum of innovation is Valeri Souchkov’s 5 Levels of Solutions, which is a recategorisation of the Five Levels of Inventions in Technology by TRIZ founder, Genrich Altshuller. Altshuller’s work dates back to the fall of the Soviet Union. During that time, his views were partially informed from his experience in working at the patent office. The best way to think of a patent or invention is as a solution to a problem. Problems can vary in their level of complexity, and so too will the corresponding solution or invention vary in the hours and effort required to overcome that problem. With Altshuller’s original 5 levels, the goal wasn’t about mass-market adoption—it was about creating a classification for problem complexity. In doing so, he created a framework that could categorize the number of man-hours or trial-and-error attempts required to overcome any problem. The problems at each level increased by an order of magnitude in the number of trial-and-error attempts required for a solution to be obtained. For instance, a level 1 problem required 1–10 trials. Level 2 required 10–100 trials, and so on, up to level 5, which required in excess of 10,000 trial-and-error attempts (Altshuller, 1984).

Souchkov, who studied under Altshuller, has continued on from using the hierarchy for the purpose of invention and has adapted the classification to reflect innovativeness and novelty. This does a few things. First, it allows for the inclusion of both business and engineering applications in combination with their impact on the market. Second, it provides a way to quantify the solution of any technology, process, product, or service for benchmarking and raking purposes. Finally, it can provide innovators, consultants, or leaders with direction on the level of solution they should seek in order to attain a desired outcome. For instance, if your organisation has a strategic imperative around disrupting a mainstream market, you can tell your teams that before they even begin solution generation that level 1 and 2 quantitative and qualitative solutions are simply off the table.

Now, let’s have a look at the landscape of the solution hierarchy. There are five levels of categorization. Each level increases in complexity and pivotal effect from one to five, with five being the most difficult to achieve. The approach to categorisation is simple: review the changes made to a product or service and determine its corresponding level of solution. The levels of the solution hierarchy are as follows (Souchkov, 2007):

Level 5: Discovering a new principle

This is the creation or discovery of new knowledge.

-

- Think back to the discovery of the x-ray.

Level 4: Creating a radically new function or principle combination

This is the application of a discovery in an entirely new way or for the first time. Oftentimes this is where you’ll see a discovery that may have been in existence for some time first being used to solve a problem.

-

- With the x-ray example, it could simply be the creation of the very first imaging device.

Level 3: Extending a known function/principle combination to a new market

This solution involves taking an existing function/principle combination and applying it to either a novel problem in an existing market or creating a new market opportunity.

-

- For the x-ray example, this might be using x-ray technology in the construction industry for nondestructive testing in weld inspections.

- Another level 3 example would be using x-ray technology in construction, but this time for a different application, say for concrete inspections, where steel rebar are located within the concrete and examined for engineering requirements.

Level 2: Qualitative improvement of the existing function/principle/ market combination

Solutions at this level involve simple qualitative changes to either an entire product or its parts and often result in basic performance enhancements.

-

- An example would be improving the imaging quality of an x-ray technology device to provide a higher resolution scan.

Level 1: Quantitative improvement of the existing function/ principle/market combination

These types of solutions result from making simple quantitative changes to the product, its parts, or a combination of the two.

-

- With the x-ray example, this might involve making improvements to increase the depth or surface area of the scan.

Now, back to the objective around defining innovation. The starting point for a solution to be considered innovative begins at the 3rd level of the hierarchy, extending a known function/principle combination to a new market. Levels 1 and 2 are continuous-improvement-type solutions. These types of solutions are your classic sustaining activities, and they are unlikely to create new markets or disrupt an existing market (Christensen, 1997). The reason that we begin with level 3 is that this is the first level where we can really start to impact markets.

Assessing for Novelty: System Evolution

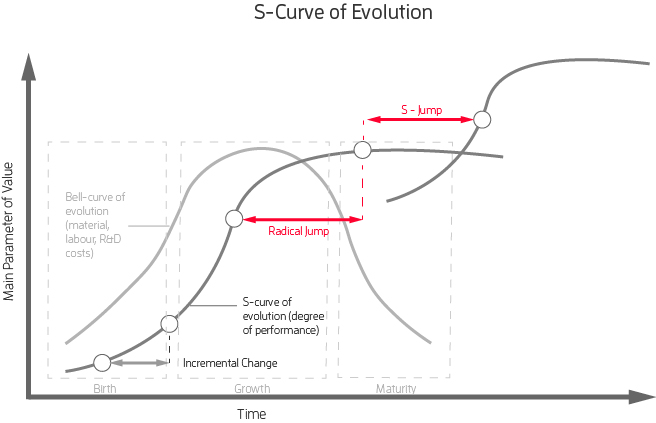

As we turn to the final piece of the puzzle and the second criterion of novelty, system evolution, we begin to consider the overall evolution of the product or service and the extent to which the changes we’ve made will progress it along its evolutionary path. There are three movements along the curve that I look at when I’m considering the degree of evolution: incremental steps, radical jumps, and s-jumps. This is a fairly straightforward step, but let me just explain the S-curve for a moment because I don’t want it to be confused with a standard S-curve of technology evolution.

The S-curve of technology evolution considers a life cycle that incorporates market adoption and traces the evolution of a performance variable in the y-axis as it moves from the stages of birth, growth, maturity, and decline. Along the x-axis, you can have any number of variables, such as cost, time, resources, and so on. The major difference here between the S-curve that we are using, which originated from TRIZ, and a standard technology S-curve, is that we are primarily concerned with the evolution of a main parameter of value (MPV) for a technical system as it evolves over time. And so in that respect we will always have an MPV in the y-axis and only ever have time plotted along the x-axis. Further to that, we only observe three stages of evolution: birth, growth, and maturity. The reason for this is that the performance of an MPV is not going to decline over time as it does with market adoption because it is not being considered from the perspective of the market, but rather performance. Meaning, if your MPV is speed—say, kilometres per hour—and the performance level reaches 800 kph, that performance variable is not going to decline over time. You may reach some natural limit, but the performance will not ratchet down as the years go by.

The S-curve can be defined at many levels—for an entire system evolution, an essential subsystem of a system, several generations of a system, or an entire technology—but irrespective of the level of analysis, the approach is the same. As technologies evolve, what tends to happen is that small incremental sustaining optimisations are made to improve the main parameter of value. These optimisations include things like reducing cost, enhancing efficiency, and improving quality, etc. But the idea is that as these optimisations are carried out, contradictions begin to arise which can impose limits on the main parameter of value.

Just for clarification, a contradiction is a situation in which a desired outcome requires an attribute to exist in two opposite states. It sounds esoteric, but it’s actually quite simple. Think of the words compromise and trade-off as I give you a couple of examples of contradictions and you’ll see what I mean. Let’s say that you only have one car between you and your partner. Normally it’s not an issue, but on this particular day you both need the car. One of you has a work meeting promptly at 9 am and the other has a long-standing appointment at the same time—and what makes it worse is that your destinations are inconveniently located on opposite ends of town. So now you’ve got a contradiction on your hands and you’re going to have to make a choice as to how you will overcome it. Would one of you take the car and the other cancel their meeting? Would you both just leave early so that one of you can be dropped off? Would one of you borrow a friend’s car or hire a car? Would you both cancel your meetings and just take the day off? These are all wrong answers, by the way. Anything other than you both using the car to get to your destination by 9 am as planned is either a trade-off or a compromise, and in TRIZ we don’t do compromises, we overcome them. Now let me give you another example of a contradiction, but this time in terms of how two contradicting MPVs can limit evolution on an S-curve.

To give you a nice example, let me use something that most of us are very familiar with. It used to be that the main parameter of value for a passenger car was speed. The engine and all of the parts of the car were enhanced and improved to help increase the speed of the car. However, we reached a certain point where it was no longer desirable to keep increasing the speed to 200–300 mph, because something else became critically important. As consumer demand for speed was well met, the concern for safety features took on an increasing role as the MPV for a passenger car. So in that respect, speed and safety formed a contradictory pair where each MPV limited the evolution of the other.

Before we continue on to the three types of movements along the curve, let me just make one very brief aside about natural limits. Every curve will have some sort of natural limit. It might be based on physical laws, current technology, or any number of factors, known or unknown. Take the speed of a propeller aircraft. The top speed of a propeller-driven aircraft is somewhere around 550 mph, notwithstanding a few edge cases. The important point to note here is that the propeller is the main source of thrust, but that it is also the propeller itself, with its piston-driven design, which is the limiting factor to achieving higher speeds. So it wasn’t all that long ago that one could say that the natural limit for aircraft speed was approximately 550 mph. Interestingly enough, we have also arrived at another contradiction. In this case what was needed to break through the natural limit was, on the one hand, that we needed an aircraft to be powered by a propeller to break speeds of 550 mph, but on the other hand, we needed an aircraft to not be powered by a propeller to break speeds of 550 mph. And as we all know, that contradiction was eventually overcome through jet propulsion.

So here is why understanding contradictions in relation to evolution is important: if a system is going to evolve, some problem, i.e., contradiction, must be overcome. And it is the extent to which a problem is solved that will ultimately lead to the significance of an MPV’s evolution.

Now let’s take this notion of overcoming contradictions and look at how we actually use the S-curve to further determine a product’s level of innovation. I mentioned before that there were three types of movements that we will be looking for. The first is an incremental step. Incremental steps along the S-curve represent your classic continuous-improvement-type changes. If you are familiar with Clayton Christensen’s work, then you can think of these as your typical sustaining innovations. So as far as incremental steps go, they may not necessarily be a bad thing, but where my definition is concerned, they don’t qualify as innovation.

Our innovation qualifier is either a radical jump on an existing curve or an s-jump onto a new curve. I’ll give you a quick example of what a radical jump can look like versus an incremental step and then I’ll finish off with the s-jump. Consider a situation where a toaster manufacturer decides to launch a new toaster into the mainstream market. Again, when working with the S-curve, the main parameter of value is mapped over time. In our case, let’s assume the MPV is the time it takes in seconds to toast a piece of bread. Now, if each year for the last 10 years, the average toast time decreased by around 15 seconds from 300 seconds down to 150 seconds, this would be an example of small incremental improvements made over time. If, on the other hand, a new toaster was introduced to the market which perfectly toasted a piece of bread in less than 30 seconds, this would be an example of a radical jump. In this example, the performance improvement was neither predictable nor incremental.

Now, let’s have a look at the s-jump. The s-jump represents a jump from an existing curve onto a new curve. Typically the existing curve is already in the maturity phase and the s-jump places it in the birth phase of a new curve. More often than not, this happens with the introduction of a new technology or principle discovery. For a brief example of the s-jump, we’ll go back to the idea of aircraft speed. Using speed as the MPV, we hit a natural limit with propeller technology. But let’s look for a second at two of the systems that make up this curve. What we actually find is that there was a jump at the natural limit of propeller-driven aircraft onto a new curve of jet propulsion aircraft. And in a very short time the speeds achieved through jet propulsion quickly surpassed the highest speeds ever attained by propeller-driven aircraft. When the s-jump does happen, you’ll end up with one of two scenarios: performance on the new curve will either be at or below the existing curve, or performance on new curve will exceed the existing curve. Obviously if performance on the new curve exceeds that of the old curve, this is a good thing, but it usually takes time. And ironically, it usually takes several iterations of incremental improvements post s-jump, often fuelled by mainstream-market adoption, to surpass performance on the old curve.

On that note about market adoption, I want to bring up one interesting point. The major difference between innovation and invention is that invention does not require a level of adoption, whereas innovation does. So, it goes without saying that to be considered a successful innovation, a product requires a level of mainstream-market adoption. In the Innovation Spectrum TM I don’t specify the required level of adoption, or the way in which that adoption should be achieved; so long as the radical jump increases adoption or the resulting s-jump leads to mainstream-market penetration or the creation of a new market, it satisfies the criteria.

Before we put all the pieces back together, I’ll mention again that with innovation, it often helps if you think of it in terms of a spectrum. It’s beneficial for scoring and categorizing your innovations, which we’ll cover in later articles, but also for enhancing reporting metrics on your scorecard. With that in mind, if we go back to our very first criterion, diffusion, a product or service must meet the requirement for global- or industry-level diffusion to land it on the Innovation Spectrum TM. Once on the spectrum, it’s simply a matter of noting the degree of novelty by having a look at the solution and evolution criteria. But what I’m effectively saying is that if a product or service is diffused at the global or industry level, then it can be considered innovation. This framework should provide you with a pretty good sense of whether or not what you’re about to implement is actually innovation, or something else.

Keep in mind that all innovations are not created equal. And of course, the framework that I’ve set out here is by no means definitive. My TRIZ comrades will note that there are several areas I haven’t mentioned, things like super-system evolution and the four indicators of a natural limit: parameter performance, number of inventions, level of inventions, and profitability, not to mention drivers of innovation and the role that they play in the innovation process. But again, my primary purpose here is not to set the precedent for the definition of innovation, but rather to arm leaders and executives with a simple definition that they can start using today. There are other definitions of innovation available, of course, ranging from the likes of the General Theory of Innovation, The Global Innovation Index, or the one provided by the OSLO Manual.

But my hope is that the definition of innovation that I’ve given you here is more robust and accessible than the one you had going into this article. And if at the very least it inoculates you against rhetorical boasting of firm-level continuous improvement as so-called innovation, then it was well worth your time.

Until next time —

References:

Altshuller, G.S. (1984). Creativity as an exact science: The theory of the solution of inventive problems. (A. Williams, Trans.). New York, NY: Gordon and Breach, Science Publishers.

Eurostat and OECD (Organisation for Economic Co-operation and Development). (2005.) Oslo Manual: Guidelines for Collecting and Interpreting Innovation Data, 3rd edition. Paris: OECD.

Souchkov, V. (2007). The five levels of solutions explained. Retrieved from https://triz-journal.com/differentiating-among-the-five-levels-of-solutions/.

Christensen, C. M. (1997). The innovator’s dilemma: When new technologies cause great firms to fail. Boston, MA: Harvard Business School Press.

INSEAD. (2011). The Global Innovation Index 2011: Accelerating Growth and Development, ed. S. Dutta. Fontainebleau: INSEAD.

Mike is the Founder and General Manager of Redshift Consulting, Founder of Praetorian Code, and Board Member to the International Business TRIZ Association. He holds a Masters in Innovation and Entrepreneurship (UMD) and a Bachelors in Psychology and Education (UCSB). He is a Certified Lean Six Sigma Black Belt (UTS); Certified Practitioner of Theory of Inventive Problem Solving (TRIZ); former US Army Ranger and a Brazilian Jiu-Jitsu fanatic.